a Canadian semiconductor strategy

An Opinion discussing Canada’s potential role in semiconductors and need for a semiconductor strategy appeared in the Globe and Mail last week. It raised some good points. In broad brush strokes: Biden is cutting ribbons, Canada was once a leader, lost corporations and IP to acquisitions and now can not afford to be left behind. […]

An Opinion discussing Canada’s potential role in semiconductors and need for a semiconductor strategy appeared in the Globe and Mail last week. It raised some good points. In broad brush strokes: Biden is cutting ribbons, Canada was once a leader, lost corporations and IP to acquisitions and now can not afford to be left behind. It was put forward that Ottawa should take stock of University IP and research, and develop a strategy for a place in the industry. A tweet from one of the authors garnered a few replies. One thread suggested that Ontario should do all this work through IP Ontario, Invest Ontario and OC Innovation. The motives are certainly very good, and it is a good discussion. Here, let’s think a bit about the industry, where Canada finds itself and how Canada might effectively move forward.

leader in semiconductors?

Was Canada ever a leader in semiconductors? Unfortunately, the answer is no. Historically, when thinking of semiconductor leaders one thinks of the big names from the United States, Japan, Taiwan, South Korea and Germany. Canadian companies have never been anywhere near IBM (always had the best fabrication technology), Intel, Texas Instruments, Micron, Fujitsu, Toshiba, Sony, TSMC, Samsung, Hynix and Seimens. We are not even close to these companies. The Opinion pointed to Tundra, Gennum and Dalsa as Canadian examples. I do not mean to diminish their technology or products, but these were not large players when compared to the above names. Tundra was a fabless designer of bridge and interface ICs, Gennum originally made hearing aides and ran a small III-V fab, while Dalsa designed specialized CCD’s. I can’t see anyone from the industry pointing to them as semiconductor leaders.

If I wrote about Canada’s contributions I would first look to ATI for their fabless design of graphic processors (GPUs). They were of course bought by AMD, who still use the “Rage” product name. AMD GPUs are well known for both gaming and crypto mining today. I would hypothesize that the kernel of current AMD circuit designs can be traced back to ATI and Canada.

I might also point to Nortel which both designed some of its own ICs and ran a fab in Ottawa. After Nortel’s fall Abbott took over the fab for their Point of Care (PoC) blood analysis division a.k.a. iStat. Abbott’s PoC sensors and much of their sensor R&D continues in Ottawa. iStat was a US based corporation but their sensor fabrication was always in Kanata. For those asking, PoC continues to have a strong presence in Ottawa. After leaving iStat, which he founded, Imant Lauks, founded Epocal, which was purchased by Siemens. Today, a third generation of PoC start-ups are growing in Ottawa.

today’s industry

Not only is Canada not on the same playing field we are not even in the stadium. The semiconductor industry is simply massive. CPUs, GPUs, image sensors (think phone cameras), Flash (think phone storage), memory, power ICs and micro-controllers are all there. The list goes on and on.

It should be noted that China has made a big push into the industry but they are not dominant. Flash and memory fabs probably account for most of their semiconductor output. China does not have state-of-the art processing. Most devices are produced at the 28 nm node, which is approximately 12+ years old now. That said it is absolutely fine for controllers that one might find in TVs or IoT stuff.

Honestly, Canada does not have the capital nor the engineering experience to start a fab from scratch for domestic designers. A single, state of the art lithography machine costs approximately $100 million. It is not even clear that domestic designers produce enough ICs i.e have enough wafer starts, to keep any domestic fab busy. I would guess that we would be headed into white elephant territory.

What about IP and patents? This is another huge minefield. Big players, think any of above names, in the semiconductor industry have some of the largest patent portfolios. They might have 5000, 10 000, 20 000 or upwards of 50 000 patents. They also know how to enforce them. Large semiconductor companies have been active licensors of IP for decades. Patent assertion and licensing talks were part of the industry long before it became trendy discussion i.e. when the CBC became interested. It was often joked that a start-up needed patents to throw in the air to distract IBM while they ran away. At the end of the day, anything originating from a new Canadian fab would be of interest to these players.

Is there a way forward? There is. I turn to Bugs Bunny. When Bugs fought The Crusher, whose character might be a large semiconductor patent holder, Bugs commented “It is about time for me to employ a little strategy”. Canada has to be strategic. We have to look to niche areas.

moving forward

who?

The idea of conducting an in-depth inventory of Canadian chip companies and University research is good. IPmart is doing just that for University and publicly funded IP. As part of the process IPmart also looks for connections between ideas and patents.

The most important thing of any inventory is that it be conducted by people that can understand the technology. I wrote about this back in 2020. The big players turn to technology experts in the field. Any company or agency should be very frequent with semiconductors and patents. An old school patent agent with whom I trained would say that you should be able to draw the invention after reading Claim 1. It is not about spreadsheets, big data or valuation algorithms. Can the analyst read the patent and understand the technology? If not, we fall into the Canadian specialty, expensive good intentions.

what?

The Opinion points to Biden’s ribbon cutting ceremonies last year. Intel and TSMC are mentioned. Intel is of course a very large American company. So, Biden is supporting a domestic entity. TSMC is Taiwanese, but their largest customer is Apple, who is looking to onshore as much of their supply chain as possible. With Apple designing their own processors i.e. the A-series for iOS and the derivative M-series for MacOS, Biden is indirectly helping another large domestic semiconductor company.

Canada does not have domestic companies of this scale. So, if we want to avoid branch-plants, which is good, we have to look to and tailor our strategy to smaller SMEs.

Where does this take us? The Opinion pointed to Tenstorrent and Ranovus. I have to admit I do not have in-depth knowledge of either, but let’s keep moving forward. Tenstorrent is developing specialized ICs for AI. I would guess they are advanced CMOS i.e. silicon logic technology. This is TSMC’s, Samsung’s and Intel’s territory and we simply can not compete. Is there an optical component? There might be.

Ravonus is working in optical. Without doing the research, Ottawa’s rich optical history, think Nortel and JDS Uniphase, makes me think some of the Ravonus crowd had connections to these now defunct companies. Anyway, optical is a whole different beast. It requires a completely different process and technology.

That is the problem. There are many different flavours of semiconductor technology. Logic is different from memory, which is different from Flash, which is different from III-V, which is different from optical. Canada will have to pick where we place our energy.

thought experiment .. a bit of fun

I want to think of three examples to draw these thoughts together. One is real and two are hypothetical.

First, the real. How about energy? We have a very big knowledge base here. Is there energy harvesting IP, and I do not mean an iron lung size mechanical system? Are there other areas that leverage semiconductors?

Acceleware is a Calgary-based company with IP around RF technology. Their first market for their technology is the oil sands. Their system would use RF, think microwaves, energy to liquify and extract oil in the oil sands. They claim this would require a fraction of the energy needed for today’s steam-based processes, and would not need water or produce tailings ponds. This and other proposed applications, including hydrogen production, could be an interesting addition to Canada’s energy industry.

How does this relate to semiconductors? The Acceleware system uses SiC-based power devices in their RF generation. Do we have SiC IP coming out of Universities? Could this IP improve the technology? Do we have any domestic fabrication capacity? I raise this example simply to think about the path forward. I want to ponder a strategic way of looking at the semiconductor challenge.

Now I want to have fun with a hypothetical best case scenario. Don’t quote me, but it was probably 15 to 20 years ago that Hewlett Packard started promoting their memristor technology. While I am not frequent with the ins and outs, it was a memory technology that would have dramatically altered the current, longstanding computing paradigm. Then, HP went silent. They likely ran into technology roadblocks that they could not solve or did not see a cost-effective way forward. This does not surprise anyone in the industry because memory is littered with technologies that did not make it to production.

OK, let’s say that the IP and technology audit found technology that would solve the memristor roadblock. It turns out that University X in Canada had IP around a bit of materials research that solved the problem. It may not even be in semiconductors, so the patent classification is irrelevant. The marketing, educating and referring crowd would not likely see this. That is fine because it is not what they are designed to do. But, someone frequent with the technology would see it. If there are ideas within Canada that can be applied to these types of problems it would make a real difference. The problem: the technology is currently lost in obscurity.

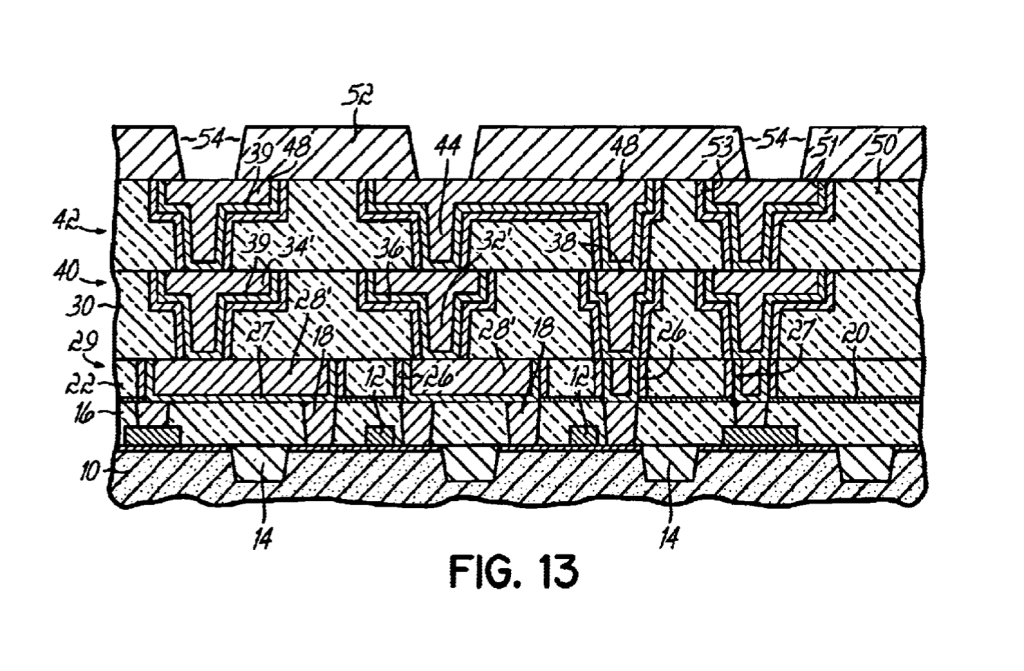

Finally, I want to think about spherical silicon. Texas Instruments had a whole slew of IP around the use of spherical silicon for solar cells, including US4,021,323 to Kilby et.al. Approximately 20 years ago ATS Automation of Cambridge, ON established Spheral Solar to bring the technology to manufacturability. The effort went silent a few years later, inferring they hit a roadblock. Again, there might be some bit of technology found in any audit that overcomes a challenge or roadblock ATS encountered, and ultimately could not solve.

Again, an energy application could possibly benefit from a focus on semiconductor knowledge that plays to an existing strength. This is what I would like to see come from any Canadian effort in semiconductors. I would like to see it solve problems.

At the end of the day Canada will have to be smart and Canada will have to be strategic. This includes knowing what people we need to move the project forward. As I have said before we will have to have the right technical knowledge in place or else the idea will be an expensive foray into the trending category. Unfortunately, this is one place where Canada has experience. Time and again it seems Canada does not even know what people are needed. Let’s not repeat it in semiconductors.